I read a total of 24 finance books, and 7 of them focus specifically on becoming a millionaire.

So I wanted to try some of the ideas from the books and see if it was as easy as they were saying it was to grow financial wealth.

I ended up trying 3 different strategies to become a millionaire (or at least get close to one lol).

🚀 Strategy #1: Start a Business

I started my business four years ago at the tail end of 2021 because at the time that's what all the books were saying to do:

- 📗 Million Dollar Weekend: https://amzn.to/44qawqB

- 📔 The Millionaire Fastlane: https://amzn.to/44qawqB

- 📔 12 Months to $1 Million: https://amzn.to/44a83Sn

But let's check in (4) years later and see how much money I have actually made after reading these millionaire books.

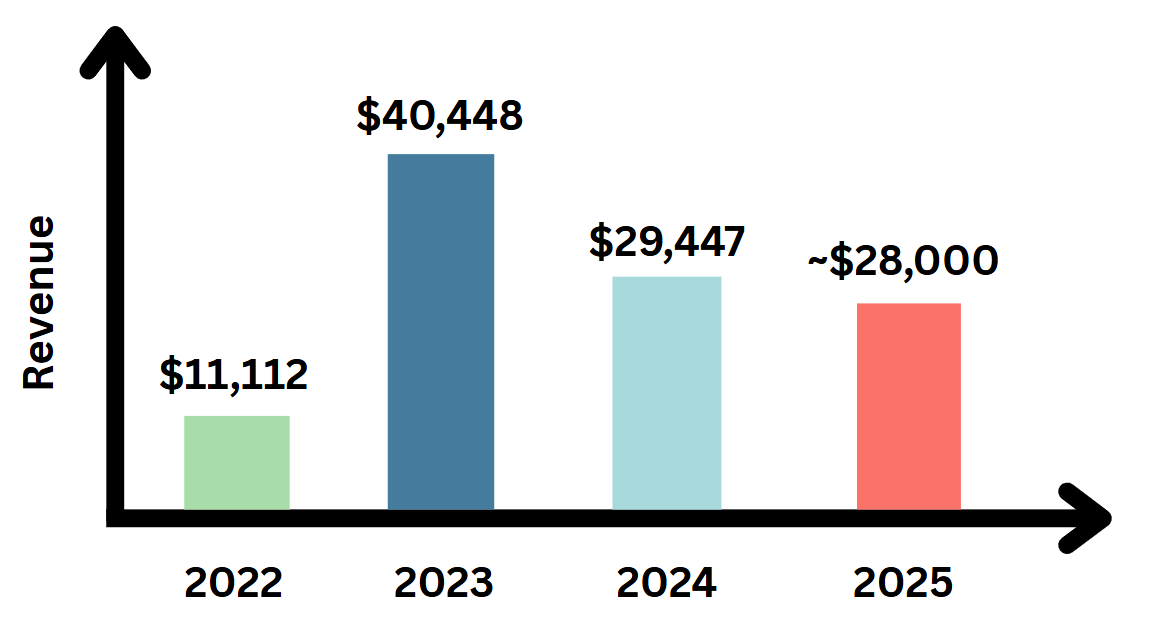

Revenue

Here is my revenue for the last (4) years of being in business.

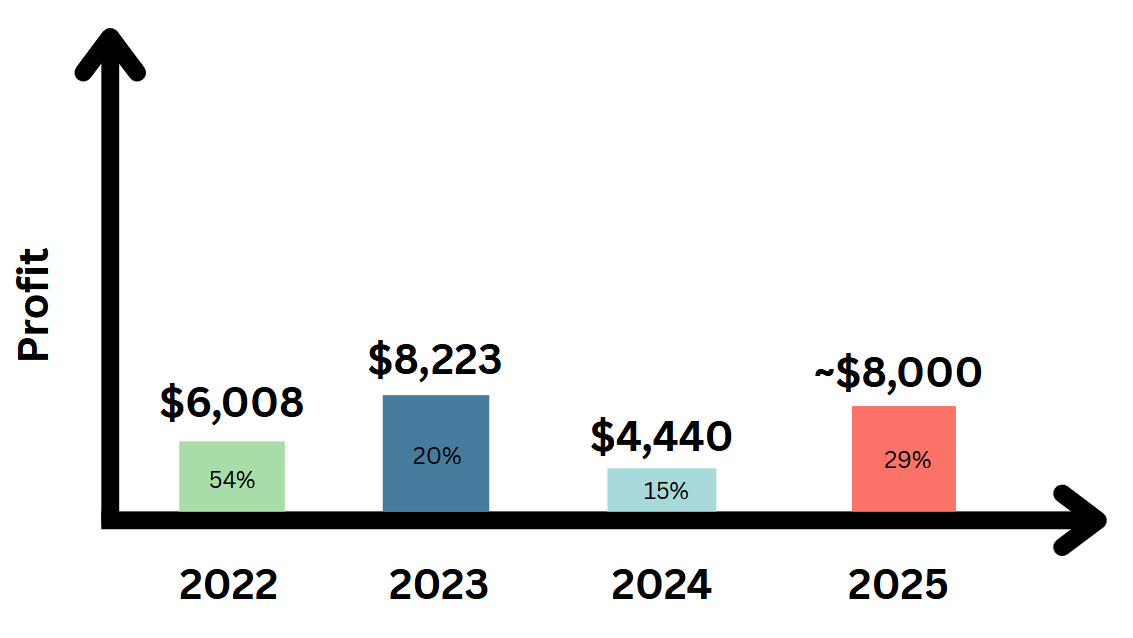

Profit

Even though I pulled in a good chunk of money I spend most of it running the actual business.

What did I spend it on?

- 🧑🏼🦰 Contract Labor: Editors, consultants, designers

- 💻 Software: Notion, Canva, Adobe, Google, Microsoft, Scribe, Ghost, Squarespace

- 🏦 Fees & Licenses: Business renewals, payment fees

- ✏️ Office Expenses: Equipment, gear, stationary

Here is where my profit has landed the last few years. Now that I have a few years under my belt, I am really focusing on cutting back on unnecessary spending which did cut into my profits back in 2023 and 2024.

Running a business is a lot of work for pretty low profits in the beginning. Its profitable and I am super proud of that, but its not the millionaire fast lane that I was promised lol.

So I only recommend this if you are in it for the long haul (including all the late nights categorizing expenses & sending invoices lol).

🔐 Strategy #2: Buy a Business

Main Street Millionaire was one of the only books I have read that talks about buying a pre-existing profitable business.

- 📔 Main Street Millionaire: https://amzn.to/4epaBiG

Sounds nice in theory - why not skip all the hard parts of starting a business?

This is how it works:

- You find a business worth buying that makes +$200k in profits a year

- You hire an operator and pay them $100k to run the business for you (you keep the rest)

- You convince the seller to sell you the business using Seller Financing (basically where you pay them back using the profits of the business over time instead of pulling out a massive bank loan)

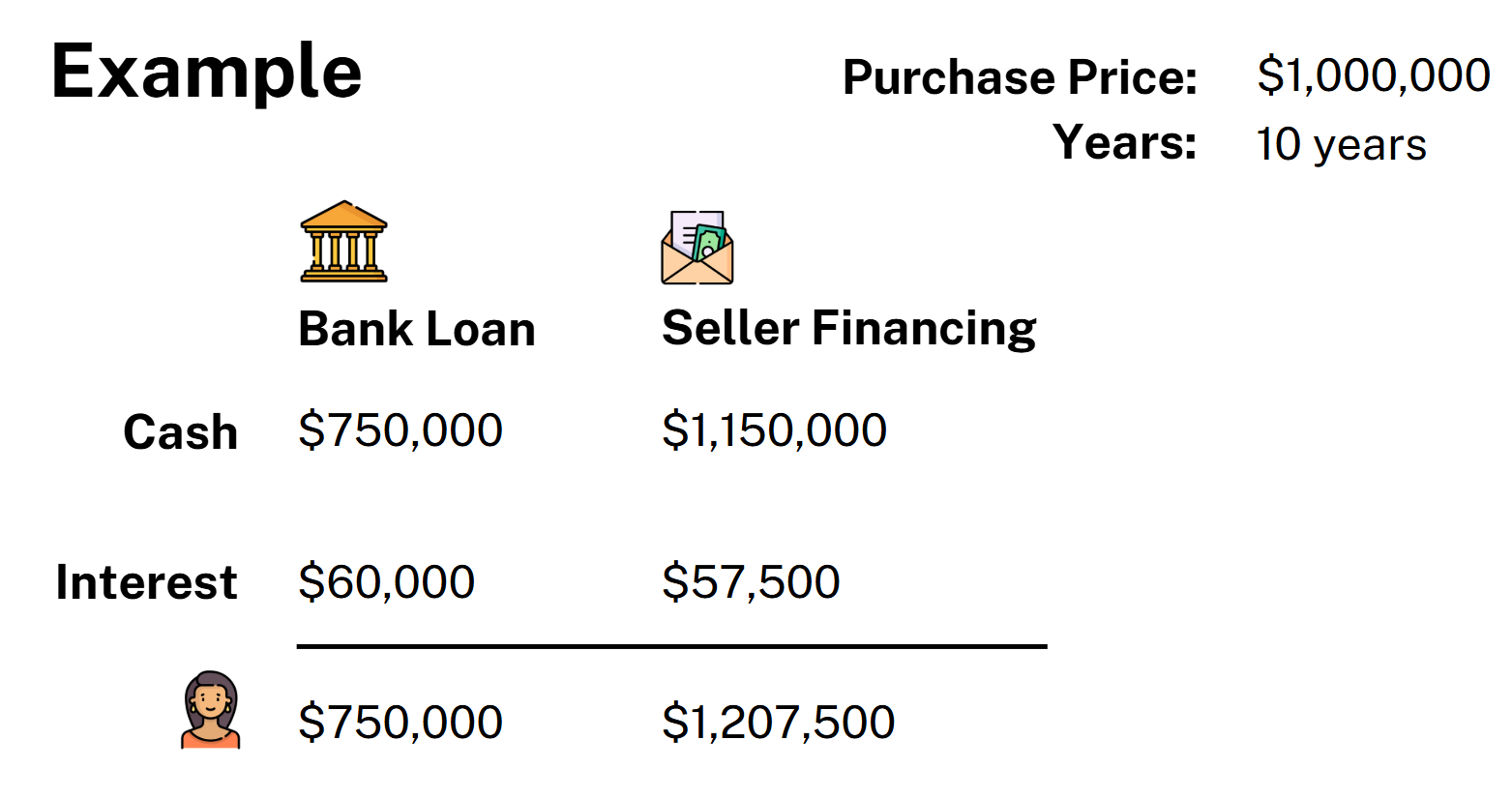

Example: Bank loan vs Seller Financing.

Option 1: You offer to buy a business using a bank loan which will only be for $750k. You can only offer $750k to the seller and you pay $60k in interest to the bank (not the seller) over time.

Option 2: You offer to buy a business using seller financing at above asking price at $1.15 M. You pay the seller $57,500 interest and you end up paying the seller way more money in the end, around $1.2M total.

It's easy to see why the seller would rather get $1.2M than $750k.

I love this idea. Only problem - who the heck would sell a 28 year old their business and trust that they would pay them over time? Not many people I know.

I decided to put this on the back burner and track all Owners I meet at events and build up my relationships before pitching someone on this idea - but I am thinking on this!

💼 Strategy #3: Employment

Now this was the best strategy but it's also kind of the lamest lol. It comes from these books:

- 📗 I Will Teach You To Be Rich: https://amzn.to/4nxlrri

- 📘 Millionaire Mission: https://amzn.to/4lh80Kr

- 📘 Rich AF: https://amzn.to/44sjjIH

This is the exact financial model that helped me grow my net worth from (-$85,000) to $401,983.

My debt included car debt (-$22,450) and student loan debt (-$48,059) = (-$70,509)

The other (-$15,000 ish) comes from original student loan debt that was sold to another loan provider pre-COVID and so I can't tell how much I paid down, but it was around $15k totaling (-$85,000 ish) in debt.

My first job (22 years old) paid $65,000 as an Estimating Engineer 1 at a construction company. I was promoted that year to Estimating Engineer 2 and made $76,500 at the same company. I tried to follow this advice with that income level and it was a disaster (I didn't make much money).

Following this model with a smaller income did not work because I couldn't afford to put a lot of money into a 401k, Roth IRA, HSA, etc. That base salary was barely enough to afford my car, rent, student loans and food - and 3-6% promos/raises were not going to cut it.

The best advice I have is to work at company for (2) years, then jump ship with a (10-20% increase) until you get to ~$130k+ WITHOUT lifestyle creep (aka don't increase your expenses). Still invest as you are at a lower income level, but you won't see much progress until are dumping enough money into these investment accounts to generate real wealth.

It took me (3) promotions and (2) job switches within (6) years to get into that high salary range (and 6 years is even considered fast). But once I had a high enough salary with extra leftover, I finally started taking advantage of the common "get rich" financial advice.

Note: I am super open to talking about money, but I know its one of those super sensitive topics (as it was in my family when I was growing up). I always loved hearing all the details about money from my friends so I hope this comes across educational, interesting and transparent. Just want to share my experience with money so far.

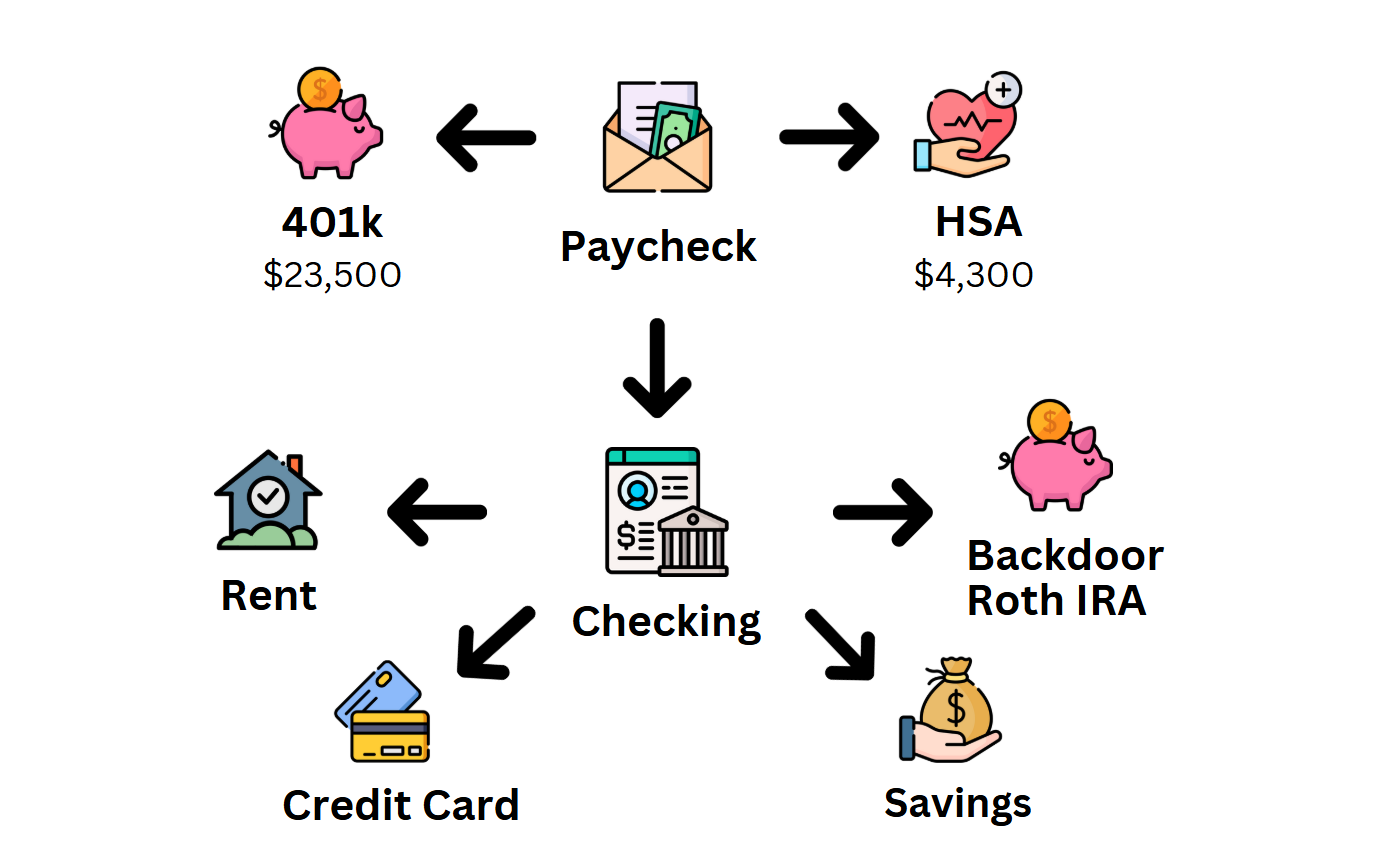

Accounts

- 401k - Maxed out at $23,500, invested into a target date fund

- HSA - Maxed out at $4,300, invested into a target date fund

- Savings - Usually try to have additional savings of 5-10% in a high yield savings account - these are my current named accounts:

- Vacations

- Conferences

- California Closet Remodel (lol)

- Taxes

- Clothing Spree (lol)

- Backdoor Roth IRA - I used to have a Roth IRA until I was close to being ineligible so now I do a conversion from my Traditional IRA into my Roth IRA with additional savings (called the Backdoor Roth IRA)

- 401k Roth - my employer allows us to convert cash (in addition to the $23,500 limit) into their 401k Roth plan (this is called the Mega Backdoor Roth) - so I have been looking into this as well

⏩ Coming Up

I just signed a sponsorship deal with Scribe (a software company I have been buying from for years - so I am extra excited!). I even negotiated a special code to get us all a discount hehe. That video should be coming out sometime late August!

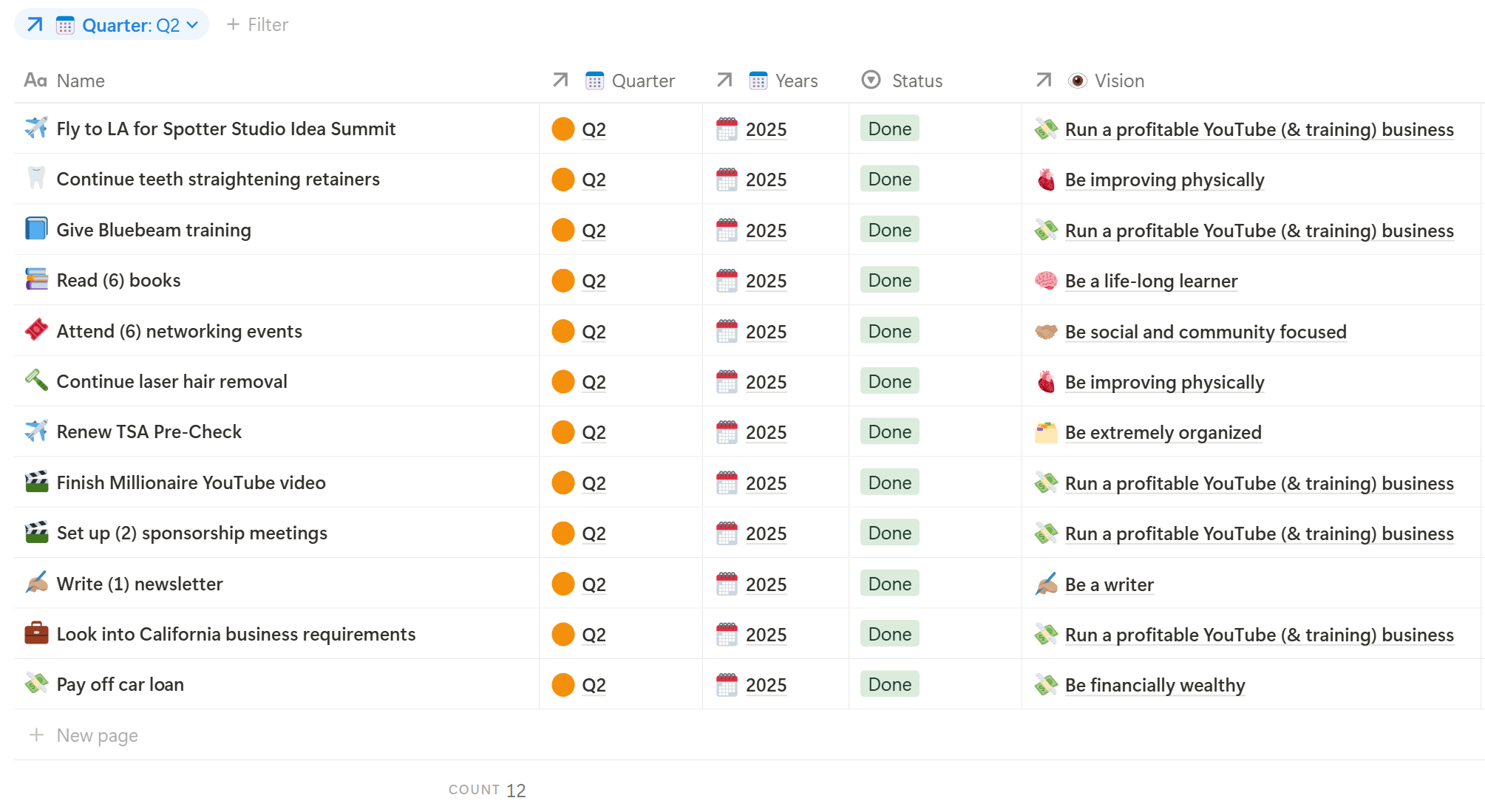

Q2 Goal Check In

We just wrapped up Q2 and I finished all (12) of my goals 🥳

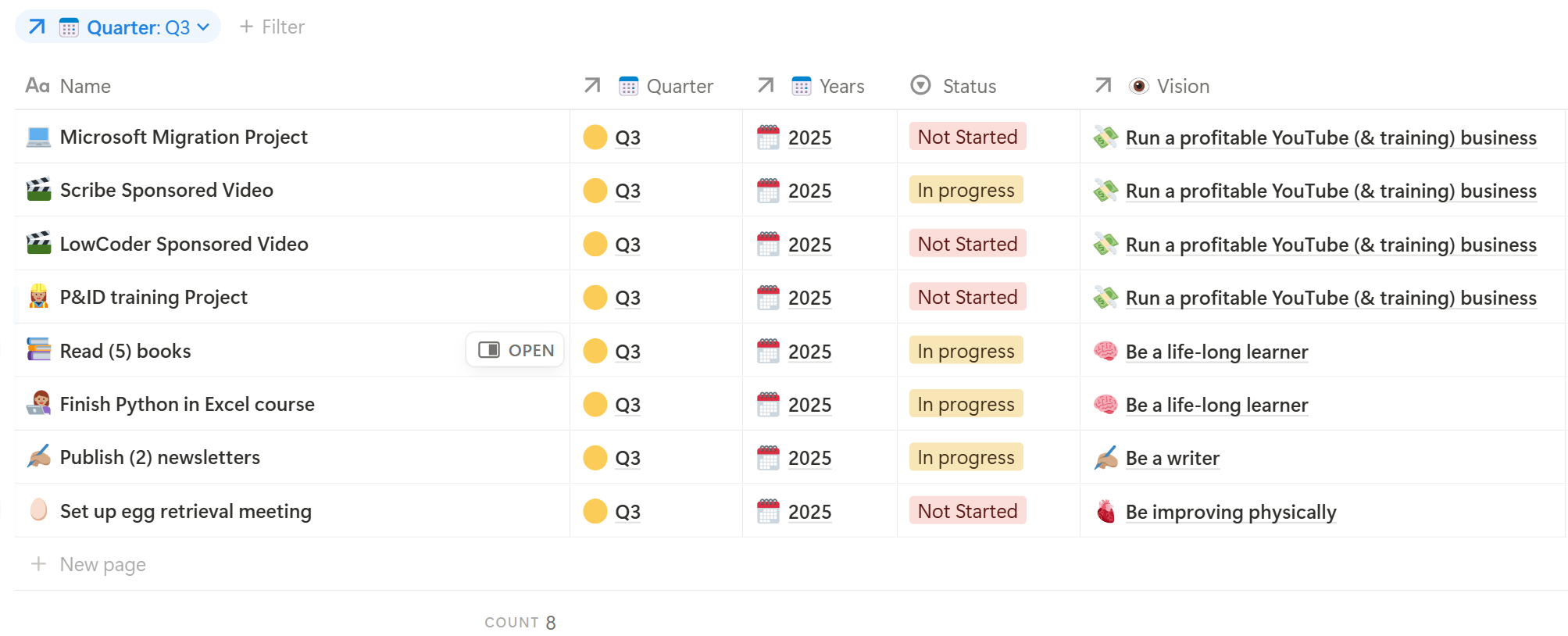

Q3 Goals

For the next quarter I narrowed it down to (8) goals this time!

🎬 Video

I posted a video yesterday with a lot more detail & it just hit 1,000 views today! 🙌🏼🥳

This is the video I got help with in LA a few months back - so I am super proud of it.